Rural lending has always carried risk – but today, that risk is intensifying. Climate volatility is reshaping global food systems and with it, the risk models that underpin rural lending, insurance and credit exposure.

“Climate-related extremes will increasingly compound food production shocks, reduce agricultural productivity, and exacerbate market volatility."

- IPCC Sixth Assessment Report (AR6), 2023

According to Howden’s CRR Insurability Report (2025), average annual agricultural losses in Europe alone are forecast to climb from €28B today to €40B by 2050 - with catastrophic years exceeding €90B. This isn’t just a European story. Chronic climate-driven yield shocks such as droughts, floods, frosts, or excess rainfall—are steadily eroding farm margins everywhere.

For lenders and insurers, this creates a dual challenge: Rising borrower risk tied to farm viability and commodity price fluctuations; and greater complexity in accurately pricing credit and insurance products.

The Underrated Risk: Cumulative Impact of Smaller Losses

Catastrophic events often capture headlines, but it’s the smaller, cumulative losses that are quietly undermining farm profitability, revenue and income year after year. as a result of chronic climate risk. These losses often slip through traditional credit risk models, yet accumulate and compound over time.

- For banks and agri-lenders, this growing yield volatility means: Unclear visibility into at-risk segments of their rural book

- Potentially higher default risk in rural-lending portfolios

- Increasing difficulty in accurately pricing risk and structuring loan products.

Why Traditional Forecasting Falls Short

Many financial institutions still rely on a mix of government-issued crop reports, customer declarations, and basic weather projections when assessing rural exposure. But as climate patterns shift - especially seasonality -the old tools and methods are insufficient.

Case in point: Southern Cross, WA. DAS’ Climate Risk Report reveals that while total rainfall has remained relatively stable over the past 30 years, (DAS climate data) the seasonal pattern of that rainfall has shifted.

- Winter rainfall—essential for traditional crops like wheat and canola—is declining by 0.35 mm per year.

- Summer rainfall is increasing by 0.43 mm per year, but tends to arrive in short, intense bursts that are less useful for crop growth.

The timing gap is just as problematic . Traditional forecastsc often deliver clarity too late—weeks before harvest or even post-harvest— too late for meaningful credit risk mitigation, re-pricing, or customer engagement strategies.

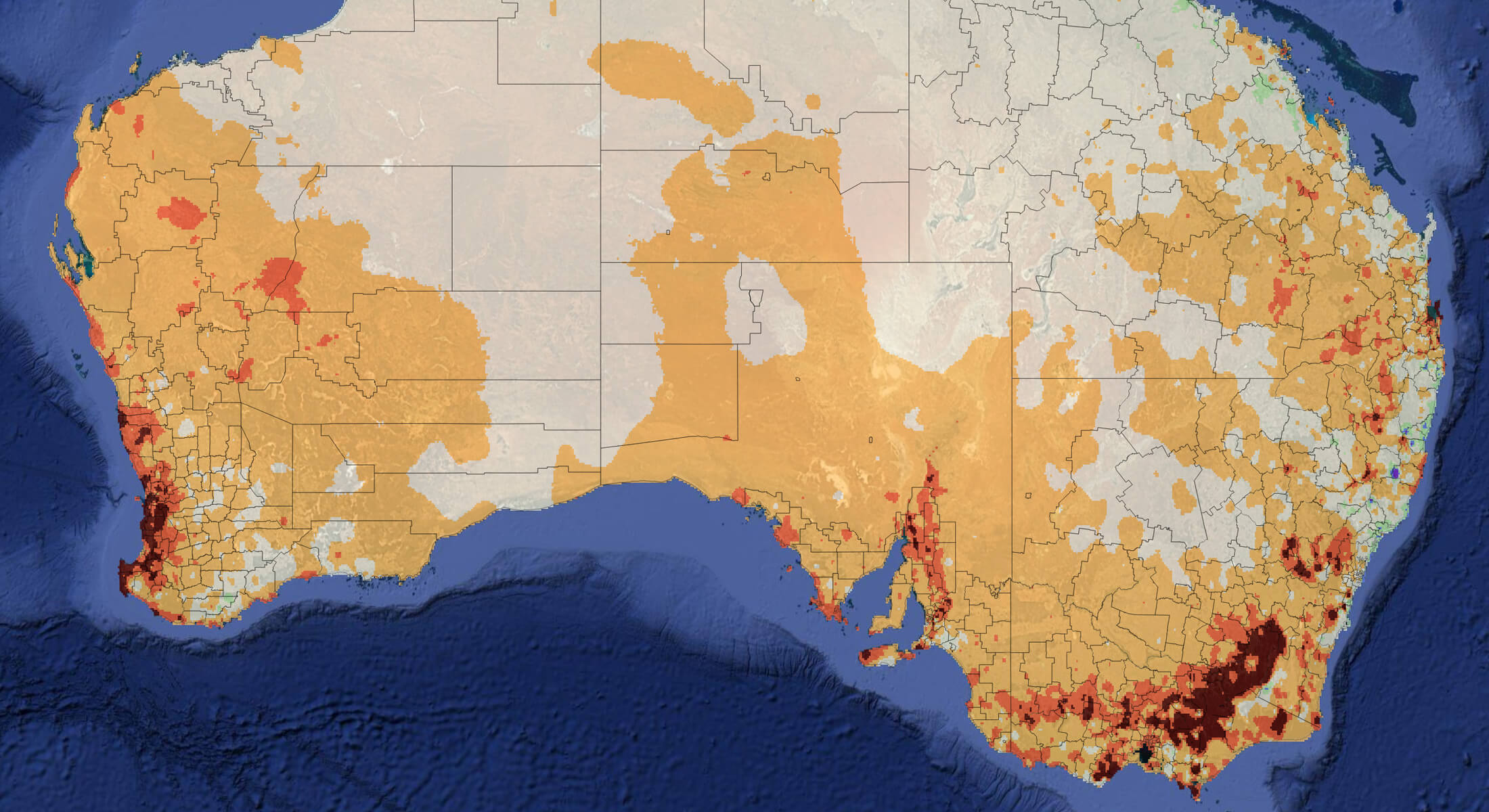

Australian Rainfall Trend (Winter) Since 1970.

Australian Rainfall Trend (Winter) Since 1970.

Enter AI-Powered Crop Intelligence

At DAS, we’ve focused on closing this gap. Our latest Crop Yield Accuracy release delivers yield forecasts that are 3–4 times more precise than the industry standard. Using our AI-powered data streams—incorporating satellite imagery, climate models, and machine learning algorithms—we provide early-season forecasts months ahead of harvest, not just weeks.

This early, sharper visibility allows financial institutions to:

- Gain earlier visibility into potential crop failures or below-average seasons, allowing proactive credit management and exposure

- Better segmenting of rural customer portfolios by production risk profile, tailoring terms and products accordingly

- Integrate unbiased data into sharper forecasts and resilience planning.

Building the Future of Climate-Intelligent Lending

Smarter lending in agriculture starts with smarter data. For rural finance leaders, adopting AI-enhanced crop forecasting is no longer a ‘nice to have’ - it’s a strategic imperative.

Financial institutions that embed climate-smart data and AI-enhanced intelligence streams into their workflows and systems will be better positioned to:

- Protect balance sheets

- Meet regulatory expectations on climate risk

Learn more about DAS’s latest Crop Yield Accuracy release.

Reference: Howden CRR Insurability Report 2025

GET STARTED WITH DAS CLIMATE DATA

DAS' Climate Data is available in the DAS Platform for both individual and enterprise-level users. Get in touch with our team to start using DAS today.