This week, parts of south east Queensland and the Northern Rivers in New South Wales are grappling with the subsequent flooding and damage left behind by Tropical Cyclone Alfred (TC Alfred). As communities, companies and authorities grapple with the impact, the Australian Securities & Investment Commission (ASIC) has called on insurers to improve their ‘immediate response’ to this event and others to come - particularly in light of the commission into the insurance industry after the 2022 floods that impacted Queensland, NSW and Victoria.

Commissioner at ASIC, Alan Kirkland, has said this week that “it’s really important that insurers have a good immediate response because people are dealing with immediate trauma, but it’s equally important they manage the claims effectively in the months that follow”.

So, how can the insurance industry respond faster to claims in events like cyclones and bushfires?

By geolocating their customer book. Yes, by utilising the best of geospatial technology and mapping customers, insurers will have one of the most valuable tools in their arsenal to predict risk and improve response to a natural disaster and validate those customers who need immediate support after the weather event comes through.

Here is an example from Tropical Cyclone Alfred.

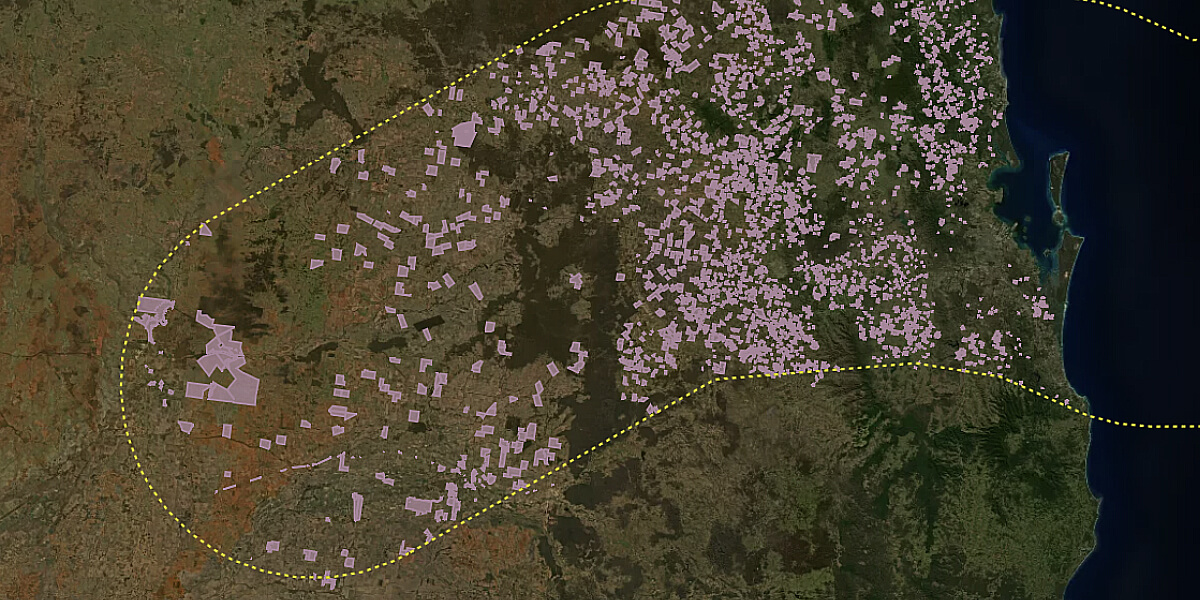

In the image below, you can see the projected path of TC Alfred overlaid on a de-identified portfolio belonging to a DAS client. This client, who had already geolocated their book, were able to access the details of their customers (in this case rural) who were likely to be affected.

The map displays the anticipated path of TC Alfred over 36 hours on 6 March 2025, using a forecast track map from the Bureau of Meteorology (BOM). The DAS Portfolio boundary outlines our clients' customers located within 100km of the cyclone's predicted path.

By identifying which properties are in the storm’s path, DAS’ client can allow the owners of those properties to simply confirm they are affected rather than report it.

When this solution is applied more widely, it can also buy time for the insurance industry or government to prepare its response and triage resources to those directly in the storm’s path ahead of time.

“Our goal here with DAS Portfolio is to help the insurance industry speed up the claim process, or help the government deliver aid and support in a timely manner to those affected. In some instances it can take months for affected properties to be confirmed by the government and then receive support. This solves that pain point and is a great example of the power of geospatial to help communities recover and expedite the process,” said Anthony Willmott, CEO of DAS.

“More broadly, this is a key tool in addressing the bigger challenge of insurance for rural properties, which not only include reducing the speed for claiming, but also addressing under-insurance and how we better protect exposed regional communities,” he said.

Are you ready to geolocate your customers?

We are ready to help get you there. Fill out our form below and our team will be in touch.