Australian planting estimates now possible weeks and months ahead of official estimates

By Anthony Willmott on LinkedIn

In the world of finance, there's a term called "Alpha". It refers to whatever you can do to gain an edge over your competitors - the kind of information and insights that give you market advantage and set you ahead of the game.

The 2021 DAS Cropping Hub is one such advantage.

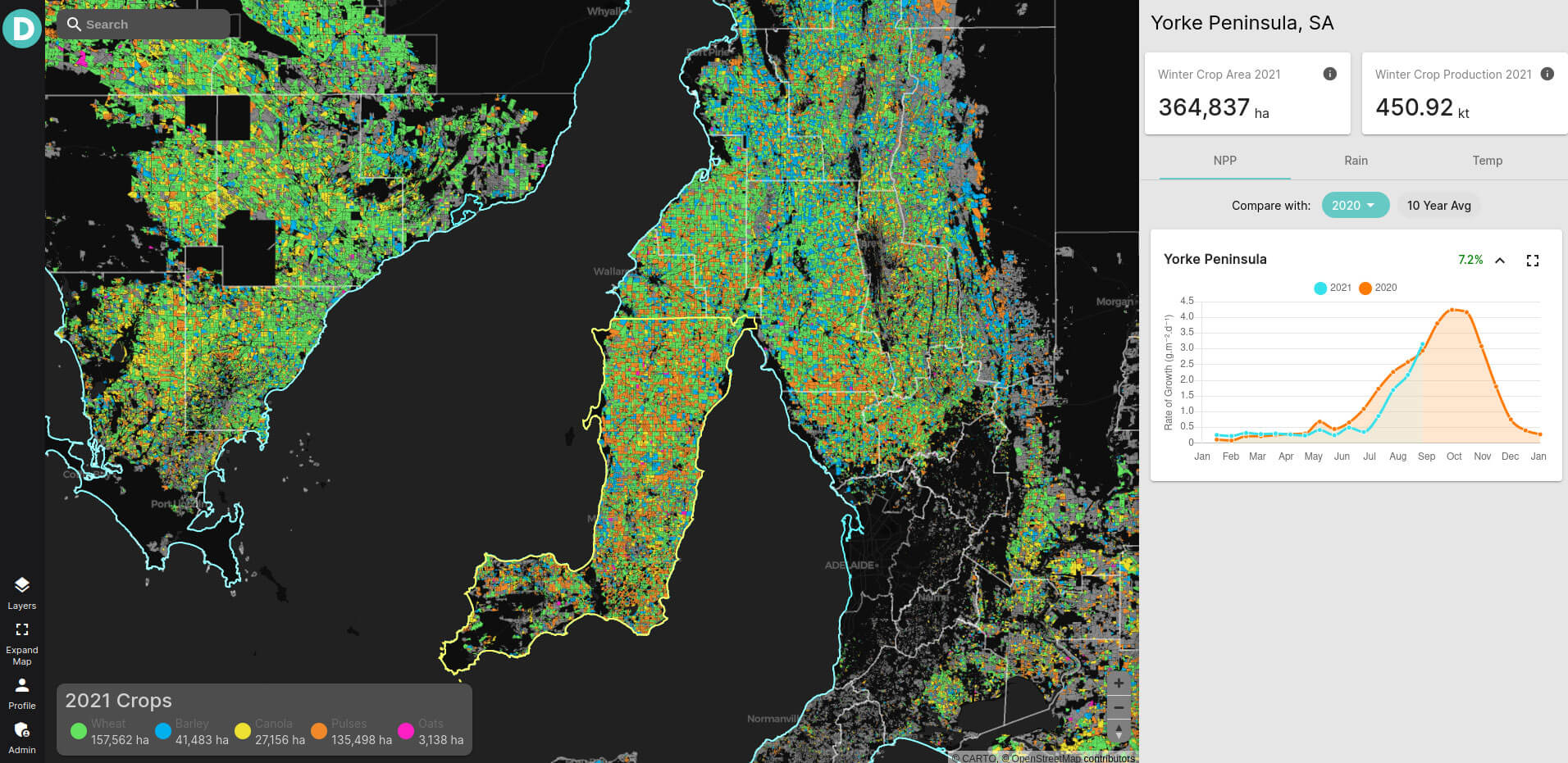

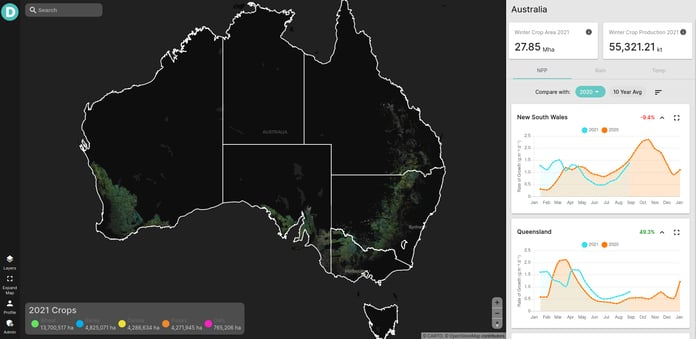

While the use cases vary, what we know is that the technology is providing non-traditional data sets for traders and investors, who are using the software to guide business and investment strategy. What's more, we have made this alternative data, as its sometimes known, useful - we can not only tell you what winter crops are growing in every 1.7 million paddocks across Australia - we can aggregate that data to answer very specific questions.

Today, at least 34 per cent of hedge fund managers in the US alone are investing in alternative data. Equally significant, almost a quarter of all hedge funds are now investing in machine learning (ML) and artificial intelligence (AI), as firms seek to gain a legitimate information edge and make ML and AI a key part of their business decision making. Both are part of the broader acceleration of digitization, which has become more urgent during the pandemic.

Over the past two years, DAS has worked to rapidly refine its technology and classification process, working alongside industry visionaries who trade grains globally. As these leaders provide unique insight and input that helps guide the development of the DAS product, we're rapidly iterating and evolving our software. And what we know is that its value and accuracy is rising.

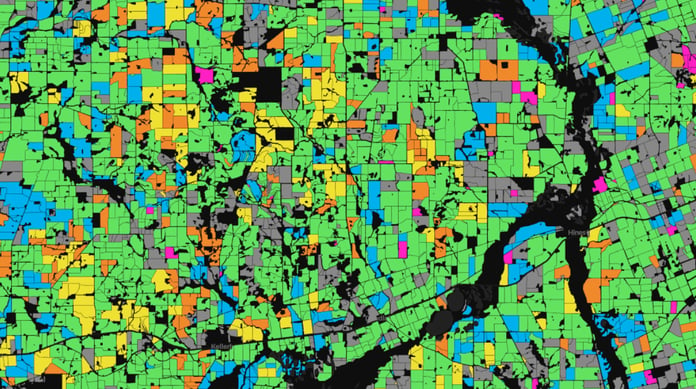

- What used to take the industry months, now takes DAS days. That's right - three days to classify the 10 most common crops at a paddock, farm, state and continental scale.

- Our Crop ID accuracy rate is now 90 per cent on average, and as high as 95 per cent.

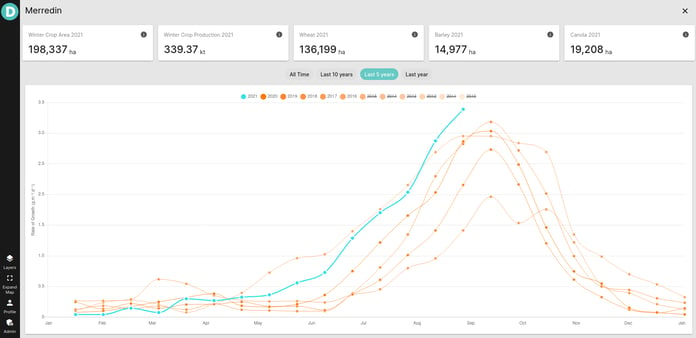

Why do we "run" our software every one to two weeks? Because crops are growing all the time. Not surprisingly, our accuracy improves as the season goes on. But tellingly, our software provides a pretty clear signal on what decision-makers might be under-estimating - or overestimating for that matter - very early on in the season.

Here's just one example:

- In June, in its initial crop forecast for the year, ABARES, the Australian Bureau of Agriculture and Resource Economics and Sciences, predicted a planted area for canola of an estimated 1.05 million hectares in Western Australia.

- In September, three months later, ABARES massively increased its production forecast and planted area forecasts - expanding its estimate of planted area for WA canola by almost half a million hectares to 1.55 million hectares.

- So what's DAS been reporting? Since mid-July, DAS has been estimating 1.64 million hectares for WA canola area planted - an early insight that has not only proven to be on target, but enormously valuable to our trading customers, as canola shapes up to be a winter cropping star performer.

Another example? We've identified significantly larger chickpea plantings in New South Wales and Queensland than others are reporting.

So what are we learning and what are some of the implications?

- Accurate, early estimation of grain yield has always had important benefits - farmers require accurate estimates for any number of reasons, from crop insurance and marketing estimates, to planning, harvest, storage requirements and cash flow.

- While our technology is still rapidly evolving, users of the DAS Cropping Hub can get updates on critical Australian crops weeks - if not months - ahead of official government estimates.

- Growers, traders and the agri-financial services industry alike can use our software to track planting trends by individual state or local government area (LGA).

- Net Primary Productivity (NPP), which uses biophysical modelling to measure plant growth throughout the season, is a critical component of our technology. As DAS furthers its vision of "putting science into the hands of decision makers", this is critical insight since NPP, as NASA says, is one way to monitor the carbon "metabolism" of the earth's vegetation.

- NPP, the best remote measure we currently have for plant biomass growth, is an increasingly critical element in countries that experience high seasonal variability in seasons, like Australia.

- That software like ours, which strengthens the connection between farming at paddock level and predicting risk in a changing climate, will only become more important

The DAS Cropping Hub for 2021 classifies winter crops including wheat, barley, oats, canola, chickpeas, faba beans, field peas, lentils, lupins and vetch. It also identifies fallow and pasture paddocks.

It uses novel machine learning approaches and multi-year ensemble models to bring ever greater accuracy to our Crop ID capability and classification, in addition to our ability to estimate and forecast yield for wheat, barley and canola.

It has the potential to monitor crops in some of the world's most important but often data-poor environments - countries which also experience a more variable climate.

It can help the industry better understand trends against a continuum of time, since DAS has Crop ID data and insights for 2020 and 2019.

Stay in the loop

Follow DAS on LinkedIn for news and updates related to our products, or subscribe to receive our Quarterly Digest newsletter.